ââStudent loan debt stories: âI had to rob Peter to pay Paulâ

For a lot of people, resuming student loan debt payments will mean their lives are turned upside down and inside out. In short, people are worried about their finances, future, family and more.

Understanding the weight of this debt, Reckon has asked readers to tell us what debt relief would mean for them and how paying back their loans would shake up their world. They appear weekly in the Broke & Bothered newsletter and regularly on our site.

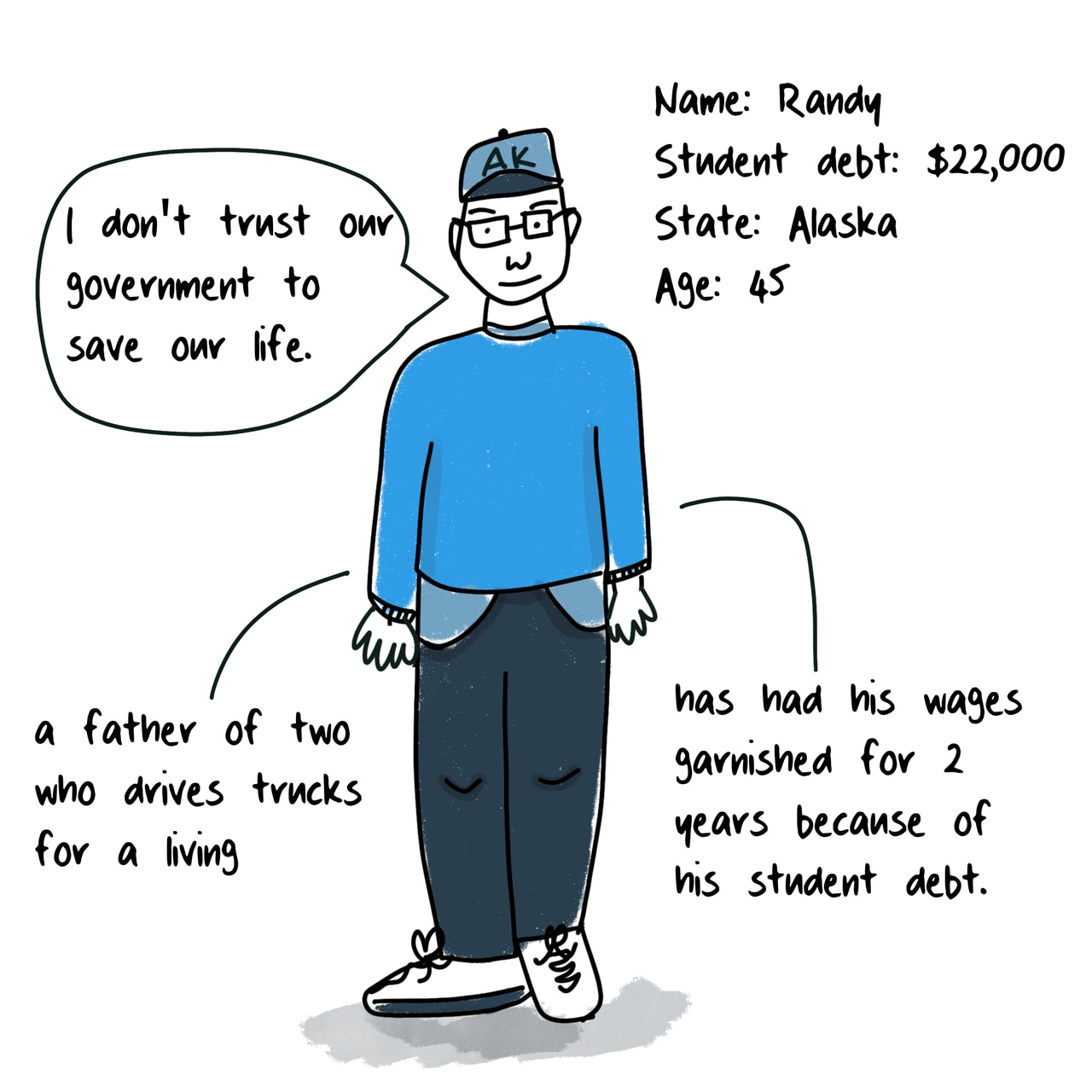

Randy I. is 45 years old, lives in Alaska and has $22,000 in student loan debt.

The following has been edited for length and clarity.

I have been able to aggressively pay off two out of the four student loans I have left, so my current debt load is around $22,000.

When I originally went to college in 2007, I had to drop out because of life stuff and a family emergency, but when I went to explain this to my college and the U.S. Department of Education they told me, “We don’t care what your circumstances are, you’re gonna pay this debt.”

My life made it so that I had to quit my job, drop out of college, move out of the state and put my loans into deferment for years.

Finally, the U.S. Department of Education got ahold of me in 2019 and informed me that they had been looking for me to pay back my loans.

I told them my situation: “I’m a single parent raising two children, I don’t get child support and I don’t receive any kind of major assistance. This is what I can afford – $100 a month.”

Then they…garnished my wages.

I had to rob Peter to pay Paul just to get through the next couple of years.

Randy I. is 45 years old, lives in Alaska and has $22,000 in student loan debt.

That was a very taxing situation, but when I finally got the letter stating that I paid my student loans and I didn’t owe anything else, I set the letter in a file and now I’m going to get it framed.

After paying my first batch of loans off, I decided to go back to college and that is what I’m currently working to pay off now.

Now knowing my loan servicer and applying for the SAVE plan, my payments will be $0 starting this October. I had a lot of questions about this plan like – Won’t that amount be compounded monthly? Why would you ask for $0 payments when it doesn’t even cover the interest?

While I later found out that the government was going to cover the interest with the SAVE plan, I don’t trust our government to save our life.

–

Want to read more student loan debt stories like Randy’s? Click here to read real stories of people most impacted by the student loan debt crisis.